best volatile stocks to trade

The stock market has always been volatile. Economic ups and downs, political activities, and changes in government rules and regulations always give a jolt to the stock market. In addition to the market's volatility, there are always a set of stocks that have greater price movements and make them amongst the most volatile stocks to trade. A volatile stock is one whose price fluctuates by a large percentage each day.

Volatility is a measure of the price change and/or return over a period of time for a specific stock or any financial instrument. The risk of volatile stocks is mitigated through different investment strategies and diversifications.

How to Trade Volatility

Trading Volatile Stocks is usually done in short bursts which fall under the category of Day Trading. In day trading, a trader is on the hunt to generate maximum profits on a daily basis. This means the frequency of buying and selling is higher in one day.

Check out our list of top day trading stocks.

Volume is one of the key indicators of a volatile stock. A stock with high trading volume makes buying and selling easy. If the trading volume is not high, you will be stuck with the purchase no matter how cheap it was.

Another key point to consider while trading volatile stocks is timing. As an investor, you need to act quickly to take maximum advantage of an opportunity. Trading volatile stocks are not easy and every second matter during its trade.

List of the Most Volatile Stocks For 2021

| Sr. | Company Name | Symbol | Beta (5Y Monthly) |

|---|---|---|---|

| 1. | Prospect Capital | PSEC | 0.93 |

| 2. | Realty Income | O | 0.72 |

| 3. | STAG Industrial | STAG | 0.92 |

| 4. | Shaw Communications | SJR | 0.44 |

| 5. | LTC Properties | LTC | 0.95 |

| 6. | Gladstone Investment Corporation | GLAD | 1.45 |

| 7. | Urban One | UONE | 1.02 |

| 8. | Alterity Therapeutics | ATHE | 0.89 |

| 9. | Simon Property Group | SPG | 1.56 |

| 10. | Carver Bancorp, Inc. | CARV | 1.41 |

1. Prospect Capital (PSEC)

Prospect Capital Corporation is a leading publicly-traded Business Development Company that focuses on delivering steady, attractive returns to our shareholders. Prospect's investment objective is to generate both current income and long-term capital appreciation through debt and equity investments.

Prospect Capital has a market capitalization of approximately $3 Billion. The average traded volume for the last 10 days is 2.15 Million shares. The 5Y Monthly Beta of PSEC is 0.93 which makes this stock moderately volatile. Its last closing price was $7.79 on 17th March 2021.

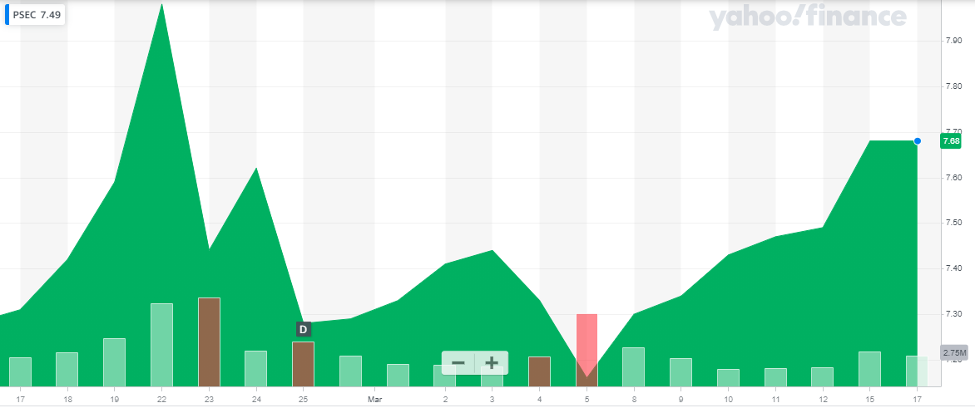

The company's stock performance for the last 30 days is as below:

The stock price has been moving up and down during the course of the last 30 days. It rose to $7.98 and dropped to $7.17 with 12 days. After which it has been rising and has reached $7.68 as of 17th March 2021.

The stock price has been moving up and down during the course of the last 30 days. It rose to $7.98 and dropped to $7.17 with 12 days. After which it has been rising and has reached $7.68 as of 17th March 2021.

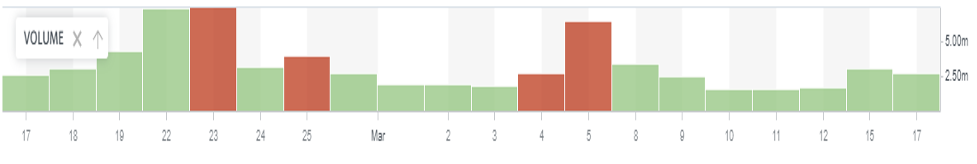

The volume chart for the last 30 days is as below:

The trading volume of Prospect Capital is very high reaching up to 7.9 million on 23rd March 2021. The stock has maintained its high trading volume during the duration of the last 30 days.

The trading volume of Prospect Capital is very high reaching up to 7.9 million on 23rd March 2021. The stock has maintained its high trading volume during the duration of the last 30 days.

2.Realty Income (O)

Realty Income, The Monthly Dividend Company is committed to providing a steady stream of monthly income to shareholders. It has been providing a steady dividend to its investors and also gives an additional bonus every year according to the company's performance.

Realty Income has a market capitalization of approximately $24 Billion. Its Average traded Volume for the past 10 days is 3.1 Million shares. The 5Y Monthly Beta for Realty Income is 0.72 which makes this stock moderate volatile. Its last closing price was $63.88 on 17th March 2021.

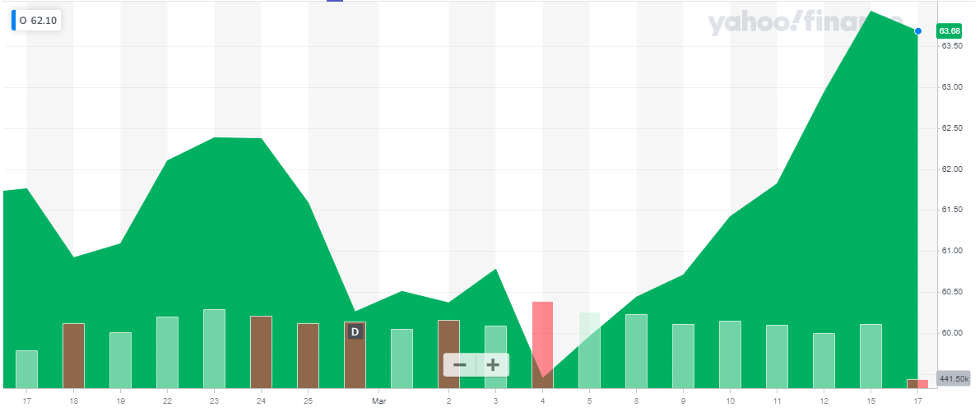

The company's stock performance for the last 30 days is as below:

The stock of Realty Income has been pretty volatile in the last 30 days. The above chart shows multiple upward and downward movements during the last 30 days. It dropped to $59.45 on 4th March 2021 and rose to $63.92 on 15th March 2021.

The stock of Realty Income has been pretty volatile in the last 30 days. The above chart shows multiple upward and downward movements during the last 30 days. It dropped to $59.45 on 4th March 2021 and rose to $63.92 on 15th March 2021.

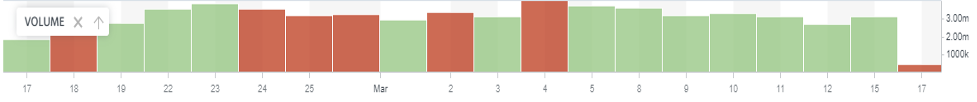

The volume chart for the last 30 days is as below:

The trading volume of Realty Income has been consistently high in the last 30 days. The highest it has reached is 4.3 million shares on 4th March 2021.

The trading volume of Realty Income has been consistently high in the last 30 days. The highest it has reached is 4.3 million shares on 4th March 2021.

3. STAG Industrial (STAG)

STAG Industrial Inc. is a real estate investment trust which operates by acquiring single-tenant industrial properties in the United States. Through this approach towards business, STAG Industrial can maintain company growth and provide its investors with a balanced return.

STAG Industrial has a market capitalization of approximately $5.4 billion. The Average Traded Volume for the last 10 days is 1.21 Million shares. The 5Y Monthly Beta is 0.92 making it a moderately high volatile stock. Its last closing price was $34.33 on 17th March 2021.

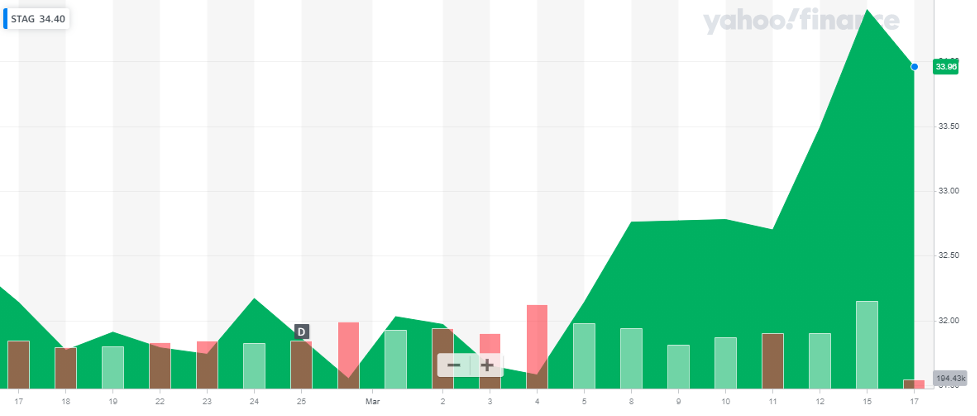

The company's stock performance for the last 30 days is as below:

The company's stock price has undergone various ups and downs during the course of the last 30 days. As shown in the above chart, there are multiple trenches and peaks within the period. STAG Industrial stock price dropped down to $31.55 on 26th Feb 2021 and rose up to $34.40 on 15th March 2021.

The company's stock price has undergone various ups and downs during the course of the last 30 days. As shown in the above chart, there are multiple trenches and peaks within the period. STAG Industrial stock price dropped down to $31.55 on 26th Feb 2021 and rose up to $34.40 on 15th March 2021.

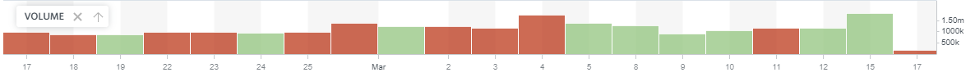

The volume chart for the last 30 days is as below:

The trading volume of STAG has been high and consistent during the past 30 days. It reached 1.74 million shares on 4th March 2021.

The trading volume of STAG has been high and consistent during the past 30 days. It reached 1.74 million shares on 4th March 2021.

As an investor, you need to stay put and wait a while before you can benefit from your investment. Investing in value stocks is a long-term investment.

4. Shaw Communications (SJR)

Shaw Communications Inc. is a leading Canadian connectivity company. It serves consumers and businesses with broadband Internet, data, WiFi, digital phone, and video services

Shaw Communications has a market capitalization of $9.7 Billion. The Average Traded Volume for the last 10 days is 3 Million shares. The 5Y Monthly Beta is 0.44. The stock closed at $28.03 on 17th March 2021.

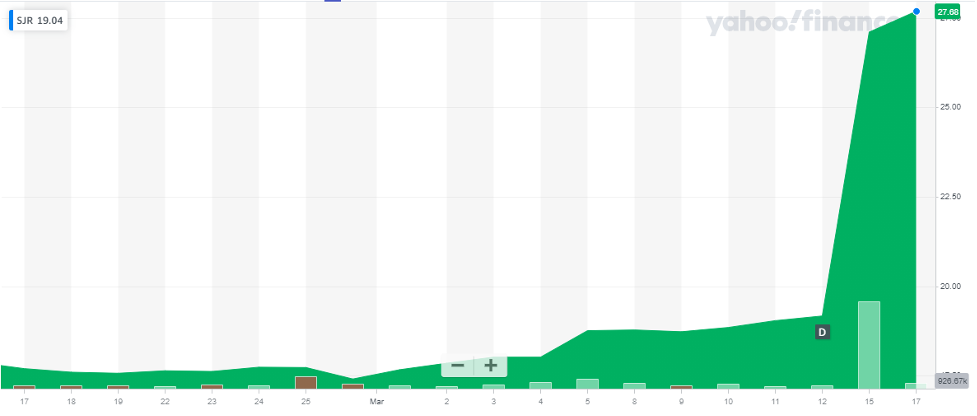

The company's stock performance for the last 30 days is as below:

The stock of Shaw Communications has been on an upward trend during this week. It reached $27.68 on 17th March 2021. There has been a sharp rise in the price of Shaw Communications stock in the previous week. There has been a 44% increase in price in the last 7 days. During the course of the last 30 days, the minimum the stock price has dropped to is $17.41

The stock of Shaw Communications has been on an upward trend during this week. It reached $27.68 on 17th March 2021. There has been a sharp rise in the price of Shaw Communications stock in the previous week. There has been a 44% increase in price in the last 7 days. During the course of the last 30 days, the minimum the stock price has dropped to is $17.41

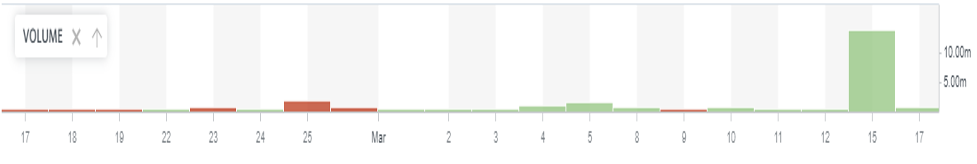

The volume chart for the last 30 days is as below:

The trading frequency has also been high and moved with the price volatility. There was an astonishing amount of trade of Shaw Communications stock on 15th March 2021. Approximately 14 million shares were traded on that day.

The trading frequency has also been high and moved with the price volatility. There was an astonishing amount of trade of Shaw Communications stock on 15th March 2021. Approximately 14 million shares were traded on that day.

5. LTC Properties (LTC)

LTC Properties Inc. is a real estate investment trust which has a diversified portfolio of well-structured leases and mortgages.

The market capitalization of LTC Properties is approximately $1.73 Billion. The Average Traded Volume for the last 10 days is 240,000 shares. The 5Y Monthly Beta is 0.95 making LTC Properties a moderately high volatile stock. The stock closed at $43.98 on 17th March 2021.

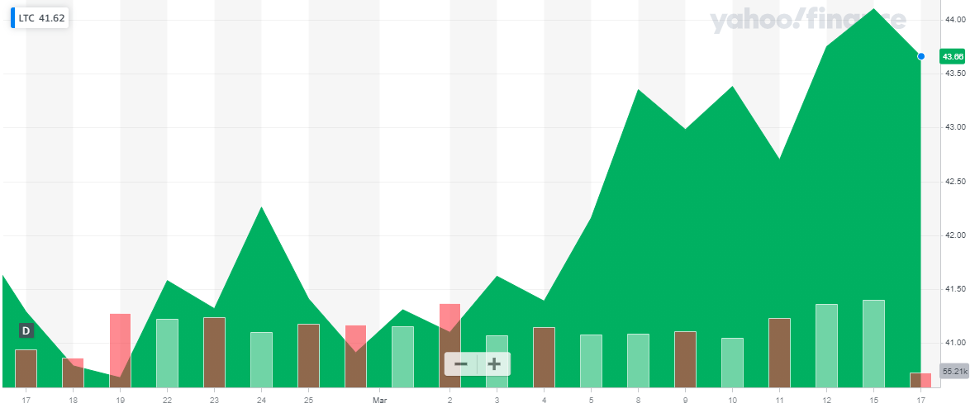

The company's stock performance for the last 30 days is as below:

The stock of LTC has been pretty volatile in the last 30 days. As per the chart above, there are multiple downward and upward trends. The stock dropped down to $40.68 on 19th Feb 2021 and rose to $44.1 on 15th March 2021.

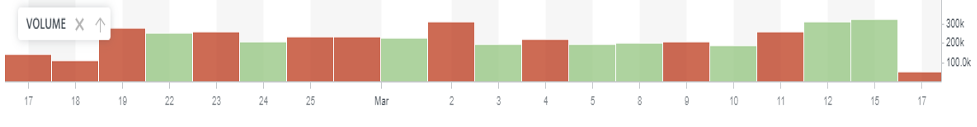

The volume chart for the last 30 days is as below:

The volume of trade has been consistent in the last 30 days. The highest traded volume traded in the last 30 days was 326,000 on 15th March 2021.

The volume of trade has been consistent in the last 30 days. The highest traded volume traded in the last 30 days was 326,000 on 15th March 2021.

6. Gladstone Investment Corporation (GLAD)

Gladstone Investment Corporation is a real estate investment trust focused on acquiring, owning, and operating net leased industrial and office properties across the United States.

The market capitalization of Gladstone Investment Corporation is approximately $327 Million. The Average Traded Volume for the last 10 days is 228,666 shares. The 5Y Monthly Beta is 1.45 making Gladstone an extremely high volatile stock. The stock closed at $10.08 on 17th March 2021.

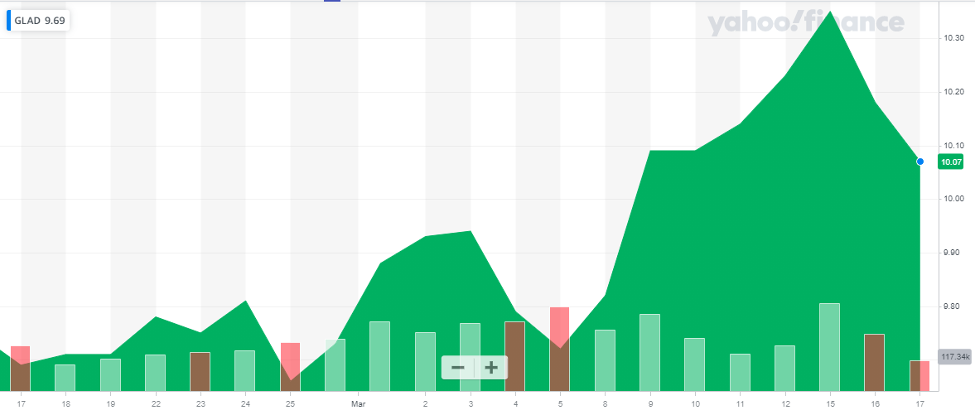

The company's stock performance for the last 30 days is as below:

The stock of Gladstone has been highly volatile on the market. As per the chart, you can observe a sharp drop and sharp increase in prices. There has been no consistent price trend. The price has been moving upward and downward in the last 30 days. The stock dropped down to $9.66 on 25th Feb 2021 and rose to $10.35 on 15th March 2021

The stock of Gladstone has been highly volatile on the market. As per the chart, you can observe a sharp drop and sharp increase in prices. There has been no consistent price trend. The price has been moving upward and downward in the last 30 days. The stock dropped down to $9.66 on 25th Feb 2021 and rose to $10.35 on 15th March 2021

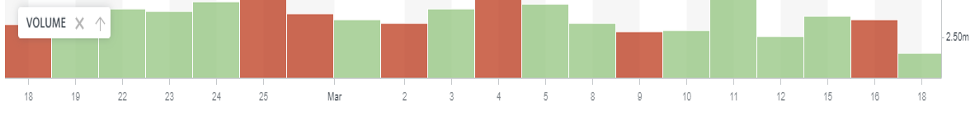

The volume chart for the last 30 days is as below:

The trading frequency of Gladstone has been consistent in the last 30 days. The highest traded volume in the past 30 days was 334,200 shares on 15th March 2021.

The trading frequency of Gladstone has been consistent in the last 30 days. The highest traded volume in the past 30 days was 334,200 shares on 15th March 2021.

7. Urban One (UONE)

Urban One Inc., together with its subsidiaries, operates as an urban-oriented multi-media company in the United States. The company operates through four segments: Radio Broadcasting, Cable Television, Reach Media, and Digital. The company majorly targets African-American and urban through its media channels.

The market capitalization of Urban One is approximately $127 Million. The Average Traded Volume for the last 10 days is 457,580 shares. The 5Y Monthly Beta is 1.02 making Gladstone a moderately high volatile stock. The stock closed at $5.95 on 17th March 2021.

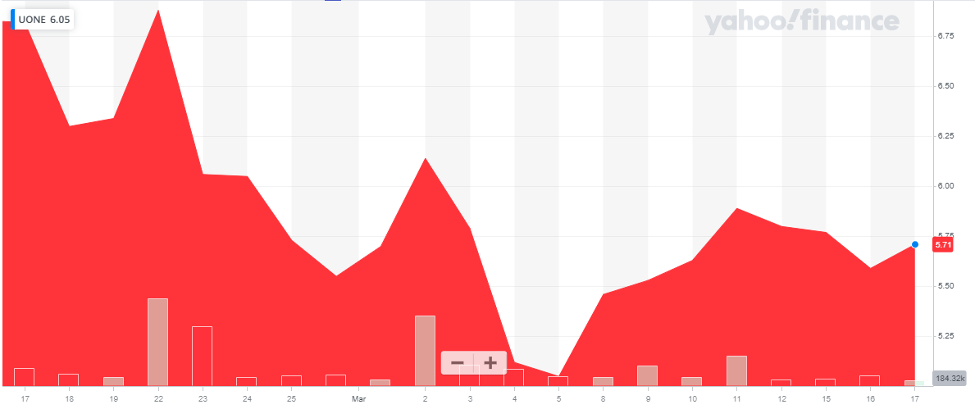

The company's stock performance for the last 30 days is as below:

The stock of Urban One has been very volatile on the market. As per the chart, you can observe multiple upward and downward movements in the price of the stock. There has been no consistent price trend in the last 30 days.

The stock of Urban One has been very volatile on the market. As per the chart, you can observe multiple upward and downward movements in the price of the stock. There has been no consistent price trend in the last 30 days.

The volume chart for the last 30 days is as below:

The traded volume of Urban One stock has been high. The traded volume rose to 3.13 million on 22nd Feb 2021, a record 900% increase in trading frequency from the previous day. Get to know about buying the dips at the blue box area

The traded volume of Urban One stock has been high. The traded volume rose to 3.13 million on 22nd Feb 2021, a record 900% increase in trading frequency from the previous day. Get to know about buying the dips at the blue box area

8. Alterity Therapeutics (ATHE)

Alterity Therapeutics Limited is a biotech company that researches and develops therapeutic drugs for the treatment of Parkinsonian's disease and other neurodegenerative diseases in Australia. The company's lead drug candidate is ATH434 is used for the treatment of Parkinson's disease. The company is in the process of developing PBT2 which will be used as an antimicrobial agent.

The market capitalization of Alterity Therapeutics is approximately $57 Million. The Average Traded Volume for the last 10 days is 550,000 shares. The 5Y Monthly Beta is 0.89 making Alterity Therapeutics a moderately high volatile stock. The stock closed at $ 1.63 on 17th March 2021.

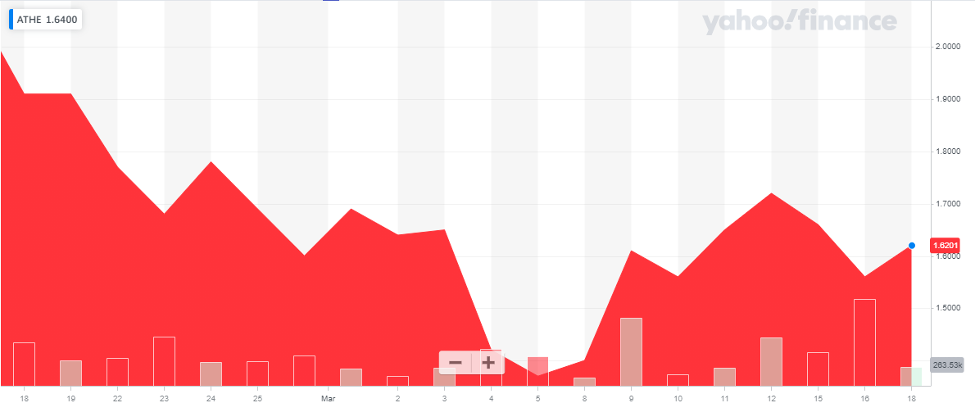

The company's stock performance for the last 30 days is as below:

The stock of Alterity Therapeutics has been very volatile on the market. As per the chart, you can observe multiple trenches and peaks. There has been no consistent price trend in the last 30 days, the stock has been moving upward and downward. The stock price was at $1.91 on 19th Feb 2021 and dropped to $1.37 on 5th March 2021.

The stock of Alterity Therapeutics has been very volatile on the market. As per the chart, you can observe multiple trenches and peaks. There has been no consistent price trend in the last 30 days, the stock has been moving upward and downward. The stock price was at $1.91 on 19th Feb 2021 and dropped to $1.37 on 5th March 2021.

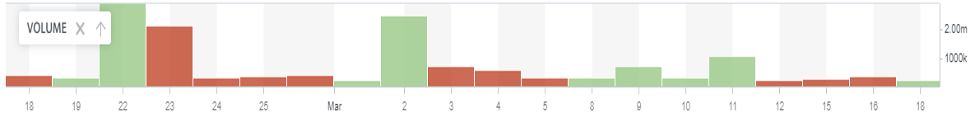

The volume chart for the last 30 days is as below:

The traded volume of Alterity Therapeutics stock has been high in the last 30 days. The traded volume rose to 1.2 million on 16th March 2021.

The traded volume of Alterity Therapeutics stock has been high in the last 30 days. The traded volume rose to 1.2 million on 16th March 2021.

Also check out our list of best penny stocks to invest in.

9. Simon Property Group (SPG)

Simon is a global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations. It is also one of the largest real estate investment trusts.

The market capitalization of Simon Property Group is approximately $39 Billion. The Average Traded Volume for the last 10 days is 3.49 Million shares. The 5Y Monthly Beta is 1.56 making Simon Property Group an extremely high volatile stock. The stock closed at $118.24 on 17th March 2021.

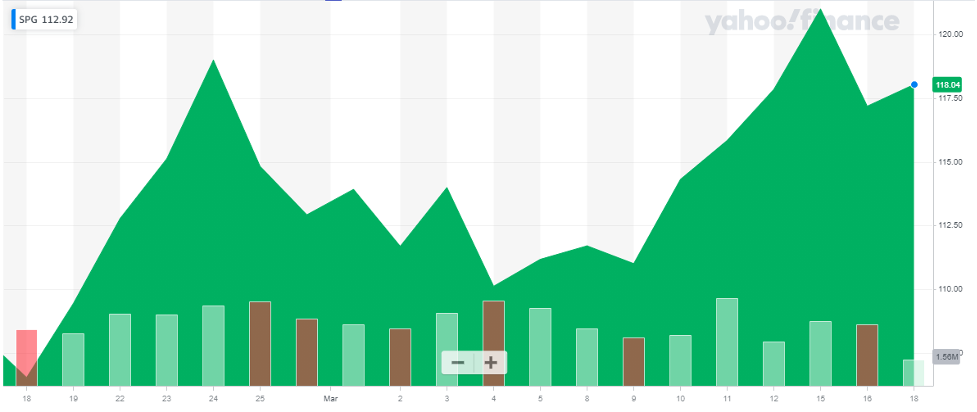

The company's stock performance for the last 30 days is as below:

The stock of Simon Property Group has been pretty volatile on the market with price moving in multiple directions. As per the chart, you can observe the stock has been moving upward and downward both in the last 30 days. The stock price was at $110.11 on 4th March 2021 and dropped to $121 on 15th March 2021.

The stock of Simon Property Group has been pretty volatile on the market with price moving in multiple directions. As per the chart, you can observe the stock has been moving upward and downward both in the last 30 days. The stock price was at $110.11 on 4th March 2021 and dropped to $121 on 15th March 2021.

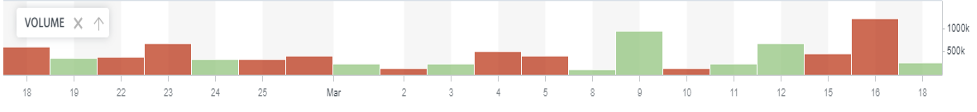

The volume chart for the last 30 days is as below:

The traded volume of Simon Property Group stock has been consistently high in the last 30 days. The traded volume rose to 5 million on 4th March 2021.

The traded volume of Simon Property Group stock has been consistently high in the last 30 days. The traded volume rose to 5 million on 4th March 2021.

10. Carver Bancorp Inc. (CARV)

Carver Bancorp Inc. is the holding company for Carver Federal Savings Bank, a federally chartered savings bank offering consumer and business banking products and services. Carver provides mortgage loans to families to purchase properties, loans; it also provides mortgage loans for construction or renovation of commercial property and residential housing development and provides a loan to the business and non-profit organizations.

The market capitalization of Carver Bancorp is approximately $37 Million. The Average Traded Volume for the last 10 days is 412,660 shares. The 5Y Monthly Beta is 1.41 making Alterity Therapeutics an extremely high volatile stock. The stock closed at $11.19 on 17th March 2021.

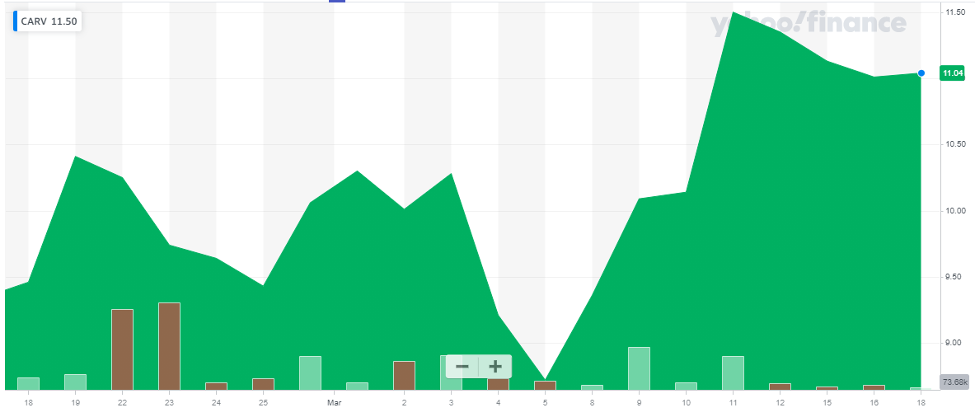

The company's stock performance for the last 30 days is as below:

The stock of Carver Bancorp has been very volatile on the market. As per the chart, you can observe multiple sharp changes in price movements in the last 30 days. The stock price dropped to $8.72 on 5th March 2021 and rose to $11.5 on 11th March 2021.

The stock of Carver Bancorp has been very volatile on the market. As per the chart, you can observe multiple sharp changes in price movements in the last 30 days. The stock price dropped to $8.72 on 5th March 2021 and rose to $11.5 on 11th March 2021.

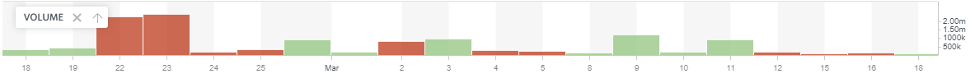

The volume chart for the last 30 days is as below:

The traded volume of Carver Bancorp Inc stock has been high in the last 30 days. The traded volume rose to 2.4 million on 23rd Feb 2021.

The traded volume of Carver Bancorp Inc stock has been high in the last 30 days. The traded volume rose to 2.4 million on 23rd Feb 2021.

You may also like reading:

- Best Crypto Currencies To Invest

Back

Source: https://elliottwave-forecast.com/stock-market/most-volatile-stocks/

0 Response to "best volatile stocks to trade"

Post a Comment